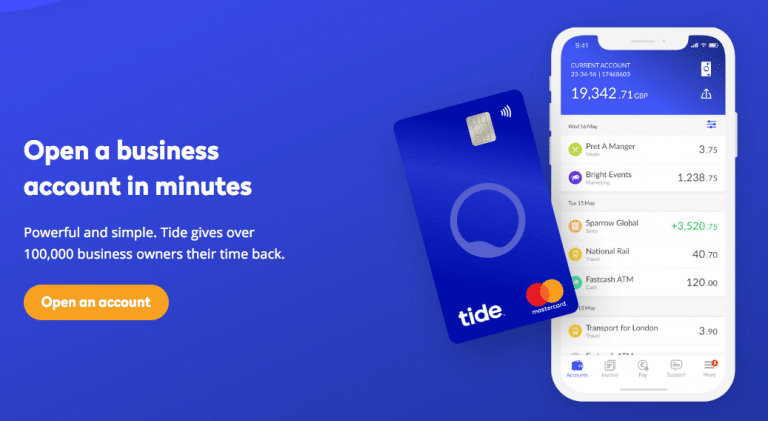

With the current improvement in information technology, clients are looking to get reliable services and products at the comfort of their homes. This is the one thing that inspired the formation of Tide.

This neobank is based in the UK and provides fast and convenient mobile business services for SMEs. It enables small and large enterprises to digitally set up current accounts, after which they can start to access convenient financial services. We want to take you through everything you need to know about Tide Neobank.

Why Does My Business Need Tide Neobank?

Understandably, neobanks are not in any way obscure in the current market. It is a kind of financial management system that is meant for businesses and persons that are tech-savvy. If you are still not aware, below are some of the services that you might get from Tide Neobank:

- Savings and checking accounts

- Loans for businesses and individuals

- Services related to payment and money transfer

- They can also help with budgeting

From the list above, you can learn that Tide Neobank is likely to come in handy, especially if you run a business and need some quick cash to meet urgent needs. Other than the features aforementioned, let us take a look at what sets Tide Neobank from traditional banks and credit unions, which are quite similar.

- Neobanks do not have branches

- They might not be categorized as financial institutions by federal regulators

- Most of their services work best with mobile devices

Note that some neobanks come from existing banks and credit unions, but they tend to operate separately from them. In the past few years, Tide Neobank has amazingly enhanced customer experience through incredible baking services.

What are the Pros and Cons of Tide Neobank?

It is safe to mention that Tide Neobank is one of the most reliable financial management solutions in the community living in the UK. Nevertheless, anything that has advantages must have some disadvantages. Therefore, as we explore some of the reasons your business might need Tide Neobank, in the form of advantages, we might mention one or two drawbacks to help you make an informed decision.

Pros

Here are some of these pros :

1. Low Costs

Products or services offered by the bank are extremely inexpensive compared to what you might spend on other financial platforms. That being said, the neobank does not feature a monthly maintenance fee.

2. Improved Transparency

There is amazing transparency at Tide Neobanks. When you choose to bank with them, expect a fewest “gotchas” such as sudden exorbitant charges and overdraft penalties. With Tide Neobanks, you have the freedom only to spend what you have.

3. Reliable Technology

If you are someone that trusts technology and are looking to do most of the things by simply tapping on the phone a few times, then you belong in the Tide Neobank. Also, it is possible to manage your finances and predict action in your account.

4. Fast Loan Approval

If you need some quick cash to run an errand in your business or to do other things, Tide Neobank is the ideal choice for you. They have innovative technology to evaluate your credit score in a matter of seconds and disburse the loan to your account.

Cons

As mentioned before, though change is a good thing, there are a few things here and there that you need to be aware of. They include :

1. Deposit Insurance

Before you start embracing the benefits of neobanks, you should know that their funds are not insured. Therefore, before you choose to keep your money at Tide Neobank, you must first verify that there is deposit insurance.

2. Consumer Protection

The current laws and regulations have nothing to do with the neobanks, Tide involved. In case of poor services, or violation of a given term, who takes the blame? In case of anything, you as a consumer do not have any legal channel to find justice.

3. There is no Actual Branch

Though this might seem like a trivial issue, in some cases, you might need to visit a physical facility to serve certain needs. The fact is that you are likely to get a lot done in person, but that is not what you get from neobanks.

How to Open an Account with Tide Neobank

You can open only one Tide Neobank account, and you will not incur any charges. The steps of opening the account are easier to follow than you might think. Whether you plan on doing it on your PC or by downloading an app, the process only takes a few seconds.

First, you have to key in your first name, followed by the last name. You will then be asked to enter your email address (the email address of the company), company or trading name, and you are set. When that is done, you will be prompted to key in some business details before activating your account.

Note that the processes are the same, whether you are doing it via an app or from your personal computer.

What to Keep in Mind

Though you might not be sure that these are services that you might need, they matter a lot to you as a business operator or as a person. Tide Neobank is an innovative company that intends to make financial management an easier task for you. Also, you can be certain that your personal information will not be shared with a third party. Once your loan has been disbursed to your account, you are given enough time to service it, and no one will ambush you until the deadline is attained. However, take note that when you default their loan, your credit score might be heavily impacted. Only apply for a loan when you are certain about your future financial status.